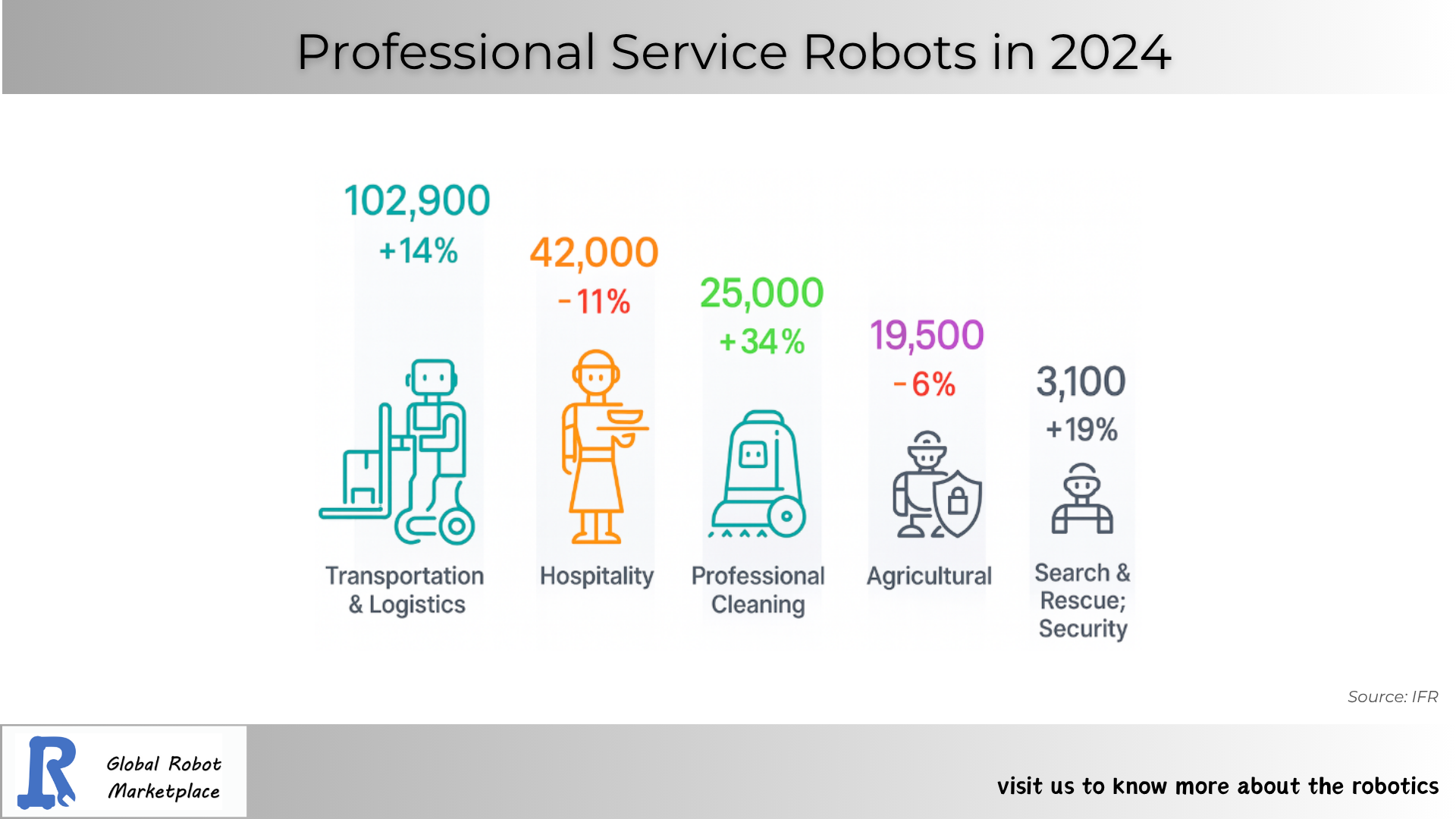

In 2024, professional service robots moved from pilot-heavy curiosity to operational infrastructure. Market volumes show clear divergence by task structure and integration complexity: Transportation & Logistics led with 102,900 units (+14%), Professional Cleaning reached 25,000 (+34%), Hospitality contracted to 42,000 (–11%), Agricultural slipped to 19,500 (–6%), and Search & Rescue/Security climbed to 3,100 (+19%) (source: IFR). These shifts reflect where autonomy, safety certification, and systems integration are sufficiently mature to deliver predictable ROI.

Professional Service Robots in 2024: A Technical Review

This article provides a segment-by-segment engineering review. For each category, we examine the autonomy stack (sensing, navigation, coverage planning), fleet orchestration and IT/OT integration, safety and compliance baselines, and the KPIs that actually govern adoption (e.g., cost per pallet-km, cost per m² at SLA, ha/hour, detection latency). We also outline deployment patterns that work in production—site surveys, digital twins, guardrailed pilots—and compare capex vs RaaS through TCO lenses. The goal is practical guidance for architects, operations leaders, and procurement teams turning robots into reliable, measurable systems.

Data snapshot and derived metrics

Units (YoY):

Transportation & Logistics (T&L): 102,900 (+14%)

Hospitality: 42,000 (–11%)

Professional Cleaning: 25,000 (+34%)

Agricultural: 19,500 (–6%)

Search & Rescue / Security (S&R): 3,100 (+19%)

Total units: 192,500

Share of 2024 volume: T&L 53.45%, Hospitality 21.82%, Cleaning 12.99%, Agricultural 10.13%, S&R 1.61%.

Implied 2023 baselines (÷ by YoY factor):

T&L 90,263, Cleaning 18,657, Hospitality 47,191, Agricultural 20,745, S&R 2,605.

Absolute deltas 2024 vs 2023: T&L +12,637, Cleaning +6,343, S&R +495, Hospitality –5,191, Agricultural –1,245.

Net market growth ≈ +13,039 units. Growth bridge contribution: T&L ~96.9%, Cleaning ~48.6%; contractions from Hospitality (–39.8%) and Agricultural (–9.5%) offset part of the gain.

Segment technical readouts

Transportation & Logistics (T&L)

Why it leads: Structured, repeatable missions in controlled, non-public indoor spaces.

Stack:

Navigation: 2D lidar + depth/IMU + wheel odometry; graph/grid SLAM; ISO 3691-4 compliant safe motion.

Orchestration: Fleet manager with traffic policies, charger allocation, mission QoS; WMS/MES/ERP adapters (REST/MQTT/OPC UA).

Infrastructure: Deterministic Wi-Fi (or private 5G) in corridors; PLC bridges for doors/elevators/conveyors.

KPIs: Missions/hr, first-attempt success rate, blocked-time %, cost per pallet-km, MTBF/MTTR, near-misses.

Acceptance tests: Route repeatability under mixed traffic, emergency stop latency, graceful degradation on RF loss.

Professional Cleaning

Why it scales: Coverage is auditable; tasks are cyclical; labor substitution is measurable.

Stack: Coverage planners (boustrophedon/spiral), persistent maps per zone, obstacle classification, consumable telemetry.

Ops: Night runs + daytime assist; fleet dashboards reporting m² cleaned, overlap %, exception heatmaps.

KPIs: m²/hr at target cleanliness, cost/m², rework rate, battery SoH drift, SLA compliance.

Hospitality

Why it retracts: High integration friction and limited, sometimes “novelty” use cases.

What works: Guided wayfinding, telepresence, targeted F&B where service windows are predictable.

Integration choke points: PMS/POS/CRM, access control, elevator APIs, guest HRI.

KPIs: Tasks/hr in guest zones, time-to-assist, upsell conversion delta, staff workload redistribution.

Agricultural

Why it dips: Open-world complexity (terrain, weather, biology), seasonal duty cycles, serviceability in remote sites.

Stack: GNSS-RTK + multi-sensor fusion; crop-stage-aware perception; implement control loops (pressure/torque).

KPIs: ha/hr, intervention accuracy (e.g., weed kill rate), fuel/energy per ha, service truck roll rate.

Engineering focus: Ruggedization (IP/ingress, thermal), connectivity fallbacks, modular implements across seasons.

Search & Rescue / Security

Why it grows from a small base: Risk removal and extended reach for patrol/response.

Stack: RGB+thermal fusion, edge anomaly detection, secure teleop with fallback autonomy, geofencing and audit trails.

KPIs: Detection latency, false-positive rate, patrol coverage %, operator:robot ratio, evidence chain integrity.

Cross-cutting engineering themes

Safety & compliance: ISO 3691-4 (AMRs), ISO 13849 / IEC 62061 (functional safety), IEC 62443 (OT security). Public-space operation often triggers additional local regulations.

Mapping lifecycle: Build → validate → drift monitor → refresh; semantic layers (keep-outs, dynamic aisles) to reduce recovery time.

Fleet interop: Movement toward open mission/route schemas (e.g., VDA-5050-style) and multi-vendor orchestration.

Connectivity: RF surveys; QoS for command/control vs telemetry; on-edge inference to ride out dropouts.

MLOps for autonomy: Versioned models, dataset lineage, A/B rollouts with rollback; exception mining from incident clips.

Deployment blueprint (evidence-first)

Scope a single high-leverage flow/zone; freeze baseline CT/throughput and safety incidents.

Site & RF survey; charger placement and keep-out design.

Digital twin / sim for traffic policies and human co-presence.

Guardrailed pilot with instrumented handoffs; strict change control.

Scale-out to multi-robot and cross-zone missions; integration hardening.

Operate to SLOs (uptime, response time); quarterly map refresh; exception review loop for retraining.

Procurement and TCO notes

Compare outcomes, not hardware alone:

T&L → cost/pallet-km, mission success %;

Cleaning → cost/m² at SLA;

Hospitality → minutes saved per task;

Agriculture → ha/hr & intervention accuracy;

Security → detection latency/false alarms.

Capex vs RaaS: choose by utilization and maintenance maturity. Model:

Annual TCO = amortized capex (or RaaS fee) + service + energy + downtime cost – (labor redeployment + throughput gain × margin).

Outlook for 2025

Expect deeper multi-vendor fleet orchestration, stronger IT/OT security baselines, richer semantic mapping, and measured autonomy gains in semi-structured outdoor work. Leaders will treat robots as components in a safety-certified, observable, maintainable system—engineered for KPIs, not demos.